Is it accurate to say that you are running an energizing startup or maybe constructing a strong and client driven brand?

In the event that truly, at that point you would without a doubt run into the test of finding the best installment door suppliers in India.

Then again, perhaps you are despondent and unsatisfied with your present passage specialist organization, and are searching for the following best and modest Payment Gateway in India who doesn’t settle on quality, execution, and the guaranteed issue free client experience for your clients. At that point, you are in the perfect spot. Before we present you the installment door list, we need to guarantee you that we don’t support a particular portal. We plan to do all the legwork and present you with the discoveries as a rundown, sparing you time, cash, and different assets.

We have considered seven parameters to list down data on the installment portal decisions. They are charges pertinent, simplicity of documentation, initiation period, sorts of internet business frameworks upheld, settlement period, accessibility of versatile applications, and others.

In this way, immediately, let us get into the rundown of top Payment portals in India .

Paytm Gateway

PayTM is one of the most perceived brands in India, particularly after demonetisation. Since they have forayed into plastic cash with Mastercards, they are entering more into our economy.

Key features of Paytm

Fees

Paytm charges 1.75 percent + GST per exchange for Indian Debit and Credit Cards, Net banking, UPI, and Indian Wallets.

Both the underlying arrangement expense and yearly upkeep charges are Rs 5,000, separately. In any case, because of a limited time special, they are being waved off right now.

Documentation

They offer problem free documentation process, which is totally on the web. You need just the examined duplicate of the dropped check, PAN Card, and a location confirmation.

Payment and multi-currency support

They bolster all worldwide installment and famous Mastercards, for example, Amex, Diners, Discover, Maestro, Master, and Visa. They aren’t supporting multi-cash exchanges yet.

Settlement period

The settlement time frame is a few days. (2 to 3)

Activation period

You can go live in two working days after you have made a record and presented your reports.

Ecommerce CMS support

They bolster an assortment of frameworks and trucking packs, for example, Zencart, WordPress, WHMCS, VirtueMart, ViArt, Ubercart, Prestashop, OSCommerce, Opencart, Nopcommerce, Moodle, Magento, Joomla Virtue Mart, Gravity structures, Easy computerized, Drupal Commerce, and CScart.

Advance support

They give kits in PHP, ASP.NET, Ruby On Rails, JSP, VB.NET, and OSCommerce

App support

They offer simple portable application coordination, and are accessible on both Android and iOS.

PayUmoney

PayUmoney is one of the mainstream Payment portals in India since they have been in the market for a more drawn out length, and have a tolerable client base essentially on the grounds that they offer each component their opposition offers and couple it with a problem free client care understanding.

Key highlights

Charges

Two percent + GST per exchange for Indian Debit and Credit Cards, Net banking, UPI, and Indian Wallets.

Three percent + GST per exchange for International Cards, EMI, and so on.

They offer their administrations with zero arrangement expense, and a yearly support charge.

Documentation

They offer issue free documentation process, which is totally on the web. You need just the examined duplicate of the dropped check, PAN Card, and address confirmation.

Installment and multi-money support

They bolster all worldwide installment and mainstream Visas, for example, Amex, Diners, Discover, Maestro, Master, and Visa.

Settlement period

Their settlement period is three days.

Actuation period

You can go live shortly. In any case, on their site, they have a condition which says the actuation relies upon documentation confirmation.

Online business CMS support

They bolster all famous web based business CMS System, for example, WordPress, WooCommerce, WHCMS, Prestashop, Shopify, Opencart, Magento, CS Cart, and Arastta.

Application support

They offer simple versatile application incorporation and are accessible on both Android and iOS.

CCAvenue

On the off chance that you are looking for multi-lingual help for both worldwide and Indian territorial dialects, at that point CCAvenue is the best decision. Aside from this, they are likewise one of the biggest installment doors in India. They offer a wide scope of installment choices, which incorporates more than 200 installment choices comprehensive of famous Mastercards, for example, Amex, Diners Club, eZeClick, JCB, Mastercard, and Visa.

Key highlights

Expenses

CCAvenue charges two percent for every exchange for Indian Debit and Credit Cards, Net banking, UPI and Indian Wallets.

It charges three percent for every exchange for International Cards, EMI, and so on.

The administration has zero beginning arrangement expense, yet they do charge Rs 1,200 for yearly upkeep for a startup account.

Documentation

They offer issue free documentation process, which is totally on the web. You need just the examined duplicate of the dropped check, PAN Card, and a location evidence.

Settlement period

The settlement time frame is seven days for all sums more prominent than Rs 1,000, which is the base sum on the exchange.

Initiation period

CCAvenue guarantees that you can go live inside an hour of enrollment. Be that as it may, for all intents and purposes, it takes around a few days to go live.

Web based business CMS support

They bolster numerous internet business CMS frameworks, for example, Buildabazaar, Cubecart, Interspire, Drupal, Magento, Joomla, Magento Go, Moodle, Martjack, OsCommerce, NopCommerce, Opencart, WordPress, PrestaShop, VirtueMart, WHMCS, and ZenCart.

Application support

They offer simple versatile application mix, and are accessible for both Android and iOS.

Razorpay

Razorpay is one of the most mainstream installments arrangements in India. It offers its clients to acknowledge, process, and dispense installments flawlessly inside its item suite. Truth be told, Razorpay offers the most elevated levels of customisation with adaptable mix at an exceptionally welcoming cost.

Key highlights

Charges

Razorpay charges two percent for each exchange for Indian Debit and Credit Cards, Net banking, UPI, and Indian Wallets.

It charges three percent for each exchange for International Cards, EMI, and so forth.

It offers its administrations with zero arrangement charge, and a yearly support expense.

Documentation

It offers an issue free documentation process, which is totally on the web. You need just the examined duplicate of the dropped check, PAN Card, and address confirmation.

Installment support

It bolsters all worldwide installment and mainstream charge cards, for example, Amex, Diners, Discover, Maestro, Master, and Visa.

Multi-money support

Razorpay is underpins various monetary standards from over a 100 nations.

Settlement period

Its settlement period is three days.

Actuation period

You can go live progressively. Be that as it may, on its site, it has a condition which says the initiation relies upon documentation confirmation.

Internet business CMS Support

It bolsters all famous web based business CMS System, for example, WordPress, WooCommerce, WHCMS, Prestashop, Shopify, Opencart, Magento, CS-Cart, and Arastta.

Portable application support

It offers simple portable application reconciliation, and is accessible on both Android and iOS.

PayPal

PayPal is one of the most famous and surely understood worldwide installments stage accessible in excess of 200 nations over the world. As per PayPal, they arrived at in excess of four billion installments, of which 1/fourth is from portable alone as ahead of schedule as in 2014 itself, and from that point forward they have always outperformed their own accomplishments. Because of its overall nearness, PayPal is one of the most favored installment portals for global exchanges.

Key highlights

Charges

Paypal charges 2.5 percent + Rs 3 for each exchange for Indian Debit and Credit Cards, Net banking, UPI and Indian Wallets.

3.4 percent to 4.4 percent per exchange for universal cards, EMI, and so on.

They charge zero arrangement expense, and a yearly upkeep expense.

Documentation

They offer problem free documentation process, which is totally on the web. You need just the filtered duplicate of the dropped check, PAN Card, and address confirmation.

Installment and multi-cash support

They support and are known for global installment and all major and mainstream charge cards. In India, they are utilized by shippers to get cash from universal clients. They bolster the vast majority of the monetary standards as they are known and work around the world.

Settlement period

The settlement time frame is 24 hours. The sum will be consequently moved from the PayPal account into the neighborhood financial balance, in the nearby cash.

Enactment period

You can go live not long after you effectively register. It has one of the most limited initiation time frames.

Web based business CMS support

They bolster all famous internet business CMS frameworks.

Application support

They offer simple portable application joining and are accessible for both Android and iOS.

Instamojo

Instamojo is very famous in India and the explanation behind it is fascinating as well. Instamojo is the main specialist co-op that enables its clients to enlist with them regardless of whether the clients don’t have a site. Following are the more explicit data with respect to why they are cherished by many fulfilled clients.

Key highlights

Expenses

Two percent + Rs 3 for each exchange for Indian Debit and Credit Cards, Net banking, UPI, and Indian Wallets.

Five percent + Rs 3 for each exchange for advanced items and documents.

They charge zero arrangement expense, and a yearly upkeep charge.

Documentation

They offer problem free documentation process, which is totally on the web. You need just the examined duplicate of the dropped check, PAN Card, and a location evidence.

Installment and multi-money support

They don’t bolster universal installment, Visa, and multi-money support yet.

Settlement period

They have a settlement time of three days.

Initiation period

You can go live with the administrations immediately dissimilar to a large portion of the challenge.

Web based business CMS support

They bolster all famous online business CMS frameworks.

Application support

They don’t bolster their administrations on an application for any stage right now.

EBS

EBS or E-Billing Solutions professes to be the principal Indian vendor account supplier to accomplish the PCI DSS 3.0 benchmarks of consistence. Moving above and beyond, EBS is additionally confirmed ISO 27001 – 2013 standard, holding fast to the security and procedure greatness which is normally examined. Henceforth you can securely accept they take security with the most noteworthy need, and are unified with the least security dangers for their clients.

Key highlights

Charges

EBS charges two percent for each exchange for Indian Debit and Credit Cards, Net banking, UPI and Indian Wallets.

It charges three percent for each exchange for International Cards, EMI, and so forth.

EBS installment portal administration charges zero introductory arrangement expenses when the unique advancement is applied. Else, it is charged at Rs 9,599. Likewise, the yearly upkeep charge is at least Rs 2,400, which is appropriate every year and fluctuates relying upon the arrangement you pick.

Documentation

They offer problem free documentation process, which is totally on the web. You need just the filtered duplicate of the dropped check, PAN Card, and a location evidence.

Installment and multi-cash support

They bolster worldwide installment and charge cards, for example, Visa, Master Card, American Express, JCB and Diners cards gave far and wide and 11 significant monetary standards.

Settlement period

The settlement time frame is inside a few days.

Actuation period

You can go live inside 24 hours of enacting the portal account.

Internet business CMS Support

They bolster numerous internet business CMS Systems, for example, Buildabazaar, Cubecart, Interspire, Drupal, Magento, Joomla, Magento Go, Moodle, Martjack, OsCommerce, NopCommerce, Opencart, WordPress, PrestaShop, VirtueMart, WHMCS, and ZenCart.

Application support

They offer simple versatile application joining and are accessible for both Android and iOS.

Fonepaisa

Albeit all installment doors nowadays ensure they have a consistent client experience among work area and portable applications, Fonepaisa is planned only with ‘versatile first’ structure reasoning in this manner bringing the universe of portable and installments together.

Key highlights

Expenses

You can arrange the arrangement expense and yearly support charge, which is one of a kind when contrasted and its opposition.

Documentation

They offer issue free documentation process, which is totally on the web. You need just the filtered duplicate of the dropped check, PAN Card, and a location evidence.

Propelled support

FonePaisa installment door administrations have a portable enhanced plan, different installment decisions including every single well known wallet and UPI, progressed UPI highlights like sweep and pay.

Installment and multi-cash support

Like challenge, they bolster every single worldwide installment, all the significant charge cards, and multi-monetary standards.

Settlement period

The settlement time frame is two days.

Initiation period

You can go live with the exchanges in two working days in the wake of making your record.

Online business CMS support

They bolster famous web based business CMS frameworks, for example, WordPress, WHCMS, PrestaShop, Opencart, Magento, and Joomla.

Application support

They offer simple portable application combination, and are accessible for both Android and iOS.

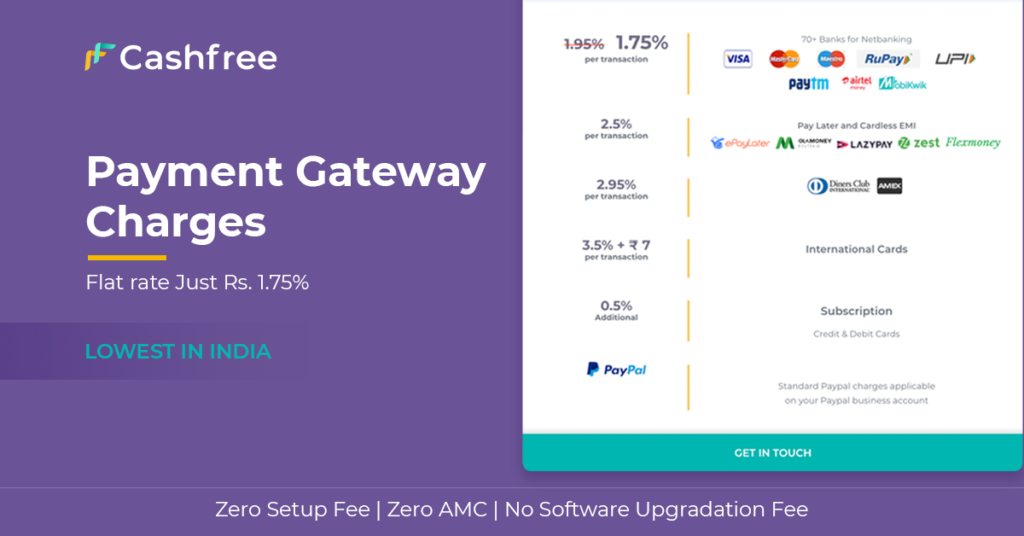

Cashfree

In the event that you are searching for mass payouts, pass on, Cashfree is the just a single accessible in India. It offers the amplest scope of installment choices for Visa, Master, Maestro, Rupay, Amex cards, more than 70 Netbanking choices, PayTM, and versatile wallets like Mobikwik, Freecharge, and Airtel. It likewise underpins UPI, PayPal, NEFT, and IMPS. They have one of the most minimal TDR charges.

Key highlights

Expenses

Cashfree charges 1.75 percent per exchange for Indian Debit and Credit Cards, Net banking, UPI and Indian Wallets.

3.5 percent + Rs 7 Per exchange for International Cards, EMI, and so forth.

The coordinated installment portal accompanies zero beginning arrangement expense, yearly support, and least yearly business prerequisite.

Documentation

They offer problem free documentation process, which is totally on the web. You need just the examined duplicate of the dropped check, PAN Card, and a location verification.

Initiation period

You can go live inside 24 hours of sign up. They are additionally one of only a handful scarcely any stages that give worldwide installments directly from the primary day.

Web based business CMS support

They bolster most famous web based business CMS frameworks with a prepared to-utilize combination framework, for example, Magento, OpenCart, Prestashop, Shopify India, Storehippo, and WooCommerce India.

Settlement period

They settlement period is only 24 hours.

Application support

They offer simple versatile application joining and are accessible on both Android and iOS. They likewise offer noteworthy, shrewd, and auto-created keen examination reports.

Kindly Post your Suggestions and Queries on Comment Box